yarcevocity.ru Market

Market

What Mutual Funds Should I Invest In Now

An ETF could be a suitable investment. Most ETFs are index funds (sometimes referred to as "passive" investments), including our lineup of nearly 70 Vanguard. Thrivent Mutual Funds offers actively-managed no load mutual funds, including asset allocation, income plus, equity, and fixed income funds. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. Both index funds and mutual funds are sold by prospectus; investors should always read the prospectus carefully before investing. Pros and cons of index funds. Mutual Funds ; UOPIX ProFunds UltraNASDAQ Fund. + (+%). +, +%, ; RYVYX Rydex NASDAQ 2x Strategy H · + (+%). Debt mutual funds invest a large proportion (at least 65%) of the total money collected from investors into fixed income securities like Corporate Bonds. Mutual funds offer diversification and convenience at a low cost, but whether to invest in them depends on your individual situation. Here's what to consider. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another broker (who may charge. The following nine investments all are standouts that might work for you if you're looking for the best Fidelity mutual funds right now. An ETF could be a suitable investment. Most ETFs are index funds (sometimes referred to as "passive" investments), including our lineup of nearly 70 Vanguard. Thrivent Mutual Funds offers actively-managed no load mutual funds, including asset allocation, income plus, equity, and fixed income funds. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. Both index funds and mutual funds are sold by prospectus; investors should always read the prospectus carefully before investing. Pros and cons of index funds. Mutual Funds ; UOPIX ProFunds UltraNASDAQ Fund. + (+%). +, +%, ; RYVYX Rydex NASDAQ 2x Strategy H · + (+%). Debt mutual funds invest a large proportion (at least 65%) of the total money collected from investors into fixed income securities like Corporate Bonds. Mutual funds offer diversification and convenience at a low cost, but whether to invest in them depends on your individual situation. Here's what to consider. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another broker (who may charge. The following nine investments all are standouts that might work for you if you're looking for the best Fidelity mutual funds right now.

If you care about climate change, your money can help shrink your carbon footprint Now there is a tool, the website Fossil Free Funds See how mutual funds. Retirement Date Funds · Inflation Protection · Bonds · US Stocks · Foreign & Global Stocks · Self-Directed Brokerage Account · Fund Policies · Investment Fund. mutual funds should read the prospectus carefully before investing. Mutual Currently selected timeframe for Morningstar Rating is Overall. Overall 3. Invest in Nuveen mutual funds across a wide You should consider the investment objectives, risks, charges and expenses carefully before investing. Our pick for the best overall mutual fund is Fidelity Index Fund (FXAIX). With an expense ratio of just %, this fund ranks as one of the cheapest in. BEST MUTUAL FUNDS ; Bank of India Flexi Cap Fund Direct Growth · ₹ · ₹1, Cr ; JM Flexicap Fund (Direct) Growth Option · ₹ · ₹3, Cr ; Quant Flexi. These funds buy investments that pay a fixed rate of return, like government bonds and investment grade corporate bonds. They may give your portfolio the chance. Money Market Funds · Source: Lipper Inc. · Retail Money Market Funds: You could lose money by investing in the Fund. · Government Money Market Funds: You could. Invest Wisely: An Introduction to Mutual Funds. This publication explains Given recent market events, you may be wondering whether you should make changes to. VTHRX is about a 60/40 stock bond split now and invests in both domestic and international. It will become more bonds as it gets closer to If you need current income from your portfolio, then an income fund may be a better choice. These funds usually buy bonds and other debt instruments that pay. List of Best Mutual Funds in India sorted by Returns ; Bandhan Infrastructure Fund · ₹1, Crs ; Nippon India Small Cap Fund · ₹60, Crs ; ICICI Prudential. EQUITY; HYBRID; DEBT; OTHERS. Filter ; Sponsored AdvInvest Now · Axis Growth Opportunities Fund - Direct Plan - GrowthLarge & Mid Cap Fund, Direct Plan, Direct. Growth funds focus on stocks that may not pay a regular dividend but have potential for above-average financial gains. · Income funds invest in stocks that pay. Top Mutual Funds ; CYPSX. ProFunds Consumer Disctnry Ultra Sec Svc, + ; CYPIX. ProFunds Consumer Disctnry Ultra Sec Inv, + ; DXQLX. By contrast, you can only buy or sell index funds only once per day, after the close of trading. You do this by contacting the mutual fund company directly and. You should consider investing in a mutual fund if the fund's objective matches your investment needs. A fund that invests primarily in stocks isn't going to be. Best Mutual Funds ; ICICI Pru Retirement Pure Equity Dir Invest Now. 5 star. Very High ; Invesco India Focused Dir Invest Online. 4 star. Very High ; JM Flexicap. Investing in mutual funds now and over time. With all this information at your fingertips, it's easy to analyze funds and decide which ones work best for you.

Idaho Home Mortgage Rates

The average rate for a fixed year mortgage in Idaho is % (Zillow, Feb. ). Idaho Jumbo Loan Rates. Idaho homes are less expensive than the average. Before you purchase a home in Idaho, check out our Mortgage Calculator Idaho to see how much home you can afford. Call New American Funding today! Compare Idaho mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Your credit score, financial history, and the current market conditions all influence the interest rate you may be eligible for. That's why I strongly recommend. Rates above based upon credit score and % down payment. *APR - Annual Percentage Rate. Apply Now Mortgage Loan Options Meet our Loan Specialists. The average Idaho mortgage was $, compared to the national average of $, Getting pre-approved will help you determine what size mortgage you can. Maximum amount of second mortgage is now 7% based on lesser of sales price or appraised value. Not to exceed the maximum LTV / CLTV approved by mortgage. Mortgages & Home Loans · Benefits that Go Above and Beyond · Are you buying, refinancing, or building? · Mortgage Calculator · Personalized Rate Quote · Contact Us. Current mortgage rates in Idaho are % for a year fixed loan, % for a 15 year fixed loan and % if you're considering a 5 year ARM. Up-to-date. The average rate for a fixed year mortgage in Idaho is % (Zillow, Feb. ). Idaho Jumbo Loan Rates. Idaho homes are less expensive than the average. Before you purchase a home in Idaho, check out our Mortgage Calculator Idaho to see how much home you can afford. Call New American Funding today! Compare Idaho mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Your credit score, financial history, and the current market conditions all influence the interest rate you may be eligible for. That's why I strongly recommend. Rates above based upon credit score and % down payment. *APR - Annual Percentage Rate. Apply Now Mortgage Loan Options Meet our Loan Specialists. The average Idaho mortgage was $, compared to the national average of $, Getting pre-approved will help you determine what size mortgage you can. Maximum amount of second mortgage is now 7% based on lesser of sales price or appraised value. Not to exceed the maximum LTV / CLTV approved by mortgage. Mortgages & Home Loans · Benefits that Go Above and Beyond · Are you buying, refinancing, or building? · Mortgage Calculator · Personalized Rate Quote · Contact Us. Current mortgage rates in Idaho are % for a year fixed loan, % for a 15 year fixed loan and % if you're considering a 5 year ARM. Up-to-date.

Boise mortgage rate trends · September 04, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. Whether you're a first-time buyer or looking for your forever home, at Westkmark we offer low rates and flexible terms on conventional, FHA, VA. Looking for current mortgage rates in Idaho Falls, ID? Here's how to use our mortgage rate tool to find competitive interest rates. Capital Home Mortgage Idaho is a full service Idaho Mortgage Company offering Idaho Home Loans with Low Rates. Call Today () Today's mortgage rates in Idaho are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check out. Home Equity Loan · Turn your home's equity into your next big purchase. Navigate that special one-time investment with top-notch interest rates and easy, fixed. Start your Idaho home buying journey today with our Idaho mortgage calculator to get an idea of the current Idaho rates. Use SmartAsset's free Idaho mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more. Mortgage rates followed that trend in Idaho, but are now seeing a gradual increase taking place. Even still, rates remain low by historical standards. As a. FHA Loan Limits for Idaho. FHA Loans are government insured mortgages from the Federal Housing Administration and are an attractive option for. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Looking to refinance your existing mortgage loan? Use ERATE ® 's rate chart to compare today's top rates in Idaho and find a lender that's the best fit for you. Idaho Housing offers unique loan products that include conventional loans, Rural Development (RD) loans in rural areas, Federal Housing Administration Loans . Today's mortgage rates in Meridian, ID are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. Bank of Idaho provides high quality residential mortgage lending in Idaho. Benefit from personalized service from experienced home loan officers. Current 30 year-fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. Understanding how interest rates work will certainly help relieve a lot of unnecessary anxiety about the home financing process. While loan programs, credit. Mortgage rates in Idaho tend to fall right in line with the national average, although they have been known to tick slightly higher at times. On Tuesday, August 13, , the average APR in Idaho for a year fixed-rate mortgage is %, an increase of 3 basis points from a week ago. Meanwhile, the. Mortgage rates in every state fluctuate daily because they are impacted by factors out of your control, such as the economy, inflation, and unemployment. Idaho.

Deposits With High Interest Rates

Relationship APY may be higher. Special Interest Rate. %. Annual Percentage Yield (APY). %. Relationship Interest Rate. Highest FD Rates of Top Banks in ; ICICI Bank, % - %, % - % ; SBI Bank, % - %, % - % ; Fincare Small Finance Bank, % -. Best High-Yield Savings Accounts for September Up to % · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY. Dcb Bank Offers High Interest Rates On Fixed Deposit For General Citizens, Senior Citizens, Nre, Nro And Fcnr Deposits. Open A Fixed Deposit Account Today. Euro area banks have managed to contain the increase in deposit costs as the repricing of deposit rates has been limited, allowing them to benefit from higher. yield on similar maturity U.S. Treasury obligations plus 75 basis points. The national rate cap for non-maturity deposits is the higher of the national rate. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Money market accounts. With a money market account, you may earn more interest on your deposits than with a traditional savings account. Rates may be lower than. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Relationship APY may be higher. Special Interest Rate. %. Annual Percentage Yield (APY). %. Relationship Interest Rate. Highest FD Rates of Top Banks in ; ICICI Bank, % - %, % - % ; SBI Bank, % - %, % - % ; Fincare Small Finance Bank, % -. Best High-Yield Savings Accounts for September Up to % · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY. Dcb Bank Offers High Interest Rates On Fixed Deposit For General Citizens, Senior Citizens, Nre, Nro And Fcnr Deposits. Open A Fixed Deposit Account Today. Euro area banks have managed to contain the increase in deposit costs as the repricing of deposit rates has been limited, allowing them to benefit from higher. yield on similar maturity U.S. Treasury obligations plus 75 basis points. The national rate cap for non-maturity deposits is the higher of the national rate. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Money market accounts. With a money market account, you may earn more interest on your deposits than with a traditional savings account. Rates may be lower than. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't.

The interest rate and annual percentage yield for your account depend upon the applicable rate tier. The interest rate and annual percentage yield for these. Deposit Interest Rate ; South Africa, , ; South Korea, , ; Sri Lanka, , ; St Kitts and Nevis, 2, View the competitive interest rates you can earn on checking, savings, and certificate of deposit bank accounts from EverBank. Savings and Spending Account Rates ; Premier Spending Account - Ambassador, %, % ; High Yield Spending Account** - Qualified with balances up to $50, -. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Fixed Deposit earns attractive interest rates, based on the tenure you choose. Start to explore the Bank of Baroda FD interest rates today! Bajaj Finance FD is the highest [ICRA]AAA(Stable) and CRISIL AAA/STABLE rated fixed deposit offering high FD interest rates and the security that the investor's. % APY Month Term Certificate Of Deposit; % APY High Yield Money Market Account. Higher Returns, Complete Security · FD Interest Rate for General and Senior Citizens(w.e.f. from Sep 7, ) · Recommended Blogs on Fixed Deposit (FD) · FD. In periods of rising interest rates, consumers are more likely to purchase term deposits since the increased cost of borrowing makes savings more attractive. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. TAB Bank offers a high-yield savings account with % APY—11 times the national average. You only need $ on deposit to earn this rate and there is no. Best FD Interest Rates in India ; Bajaj Finance Ltd. (NBFC), NBFC, %, %, Deposit Now ; SBI Bank, Bank, %, %, View details. Personal IRA CD Interest Rates ; 9 Month IRA Certificate of Deposit, , , $, $ ; 7 Month Certificate of Deposit, , , $, $ The national rate cap for non-maturity deposits is the higher of the Savings and interest checking account rates are based on the $2, product. At HDFC Bank, you can open a Fixed Deposit with amounts as low as ₹5, Invest a sum of your choice and pick from a range of tenures suitable to you. Among scheduled public sector banks, the Central Bank of India offers the highest fixed deposit interest rates of up to % p.a. on a tenure of days. A key difference between high-yield savings accounts is how often interest compounds, in other words, how frequently it's calculated. Banks can do this daily. High Yield Certificate of Deposit Rates** ; days, $1,,, %, % ; days, $1,,, %, %.

Chase Sapphire Preferred Intro Bonus

after you spend $2, on purchases in your first 3 months from account opening. Free Night Award valued up to 50, points. Certain hotels have resort fees. The Chase Sapphire Preferred® Card features a 60,point sign-up bonus when you spend $4, on purchases during the first 3 months after opening the account. For a limited time, new Chase Sapphire Preferred® Card members can earn 80, bonus points after spending $4, on purchases in the first three months from. The Chase Sapphire Preferred is my top pick for your first rewards card. Welcome bonus of 80, points worth at least $1, when used to book travel (after a. Earn 60, bonus points. after you spend $4, on purchases in the first 3 months from account opening.* Opens offer details overlay. This product is. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Travel℠. 5x5x. Sapphire is our premier credit card for travel and dining. 3X points with Reserve plus a $ annual travel credit and 2X points with Preferred. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Travel℠. CSP Welcome Offer. 60, ; Value of Intro Bonus (Points) · ; Return on Spend. 15 ; Net Value of Intro Bonus (after credits & annual fee) · ; Points from. after you spend $2, on purchases in your first 3 months from account opening. Free Night Award valued up to 50, points. Certain hotels have resort fees. The Chase Sapphire Preferred® Card features a 60,point sign-up bonus when you spend $4, on purchases during the first 3 months after opening the account. For a limited time, new Chase Sapphire Preferred® Card members can earn 80, bonus points after spending $4, on purchases in the first three months from. The Chase Sapphire Preferred is my top pick for your first rewards card. Welcome bonus of 80, points worth at least $1, when used to book travel (after a. Earn 60, bonus points. after you spend $4, on purchases in the first 3 months from account opening.* Opens offer details overlay. This product is. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Travel℠. 5x5x. Sapphire is our premier credit card for travel and dining. 3X points with Reserve plus a $ annual travel credit and 2X points with Preferred. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Travel℠. CSP Welcome Offer. 60, ; Value of Intro Bonus (Points) · ; Return on Spend. 15 ; Net Value of Intro Bonus (after credits & annual fee) · ; Points from.

Learn More > Earn 60, Ultimate Rewards® points after you spend $4, on purchases in the first 3 months from account opening. Annual Fee: $ You are a previous cardmember who has received a bonus on a Chase Sapphire credit card in the past 48 months (this includes the Preferred and Reserve); the Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ toward travel when you redeem through Chase. Its earning potential and valuable benefits can easily offset the $95 annual fee, but you can also earn 60, bonus points after spending $4, in the first 3. Earn up to 75, bonus points per year by referring friends to either Chase Sapphire® card. Learn more. Already a Sapphire Preferred cardmember? Sign in to. For a limited time, new Chase Sapphire Preferred® Card members can earn 80, bonus points after spending $4, on purchases in the first three months from. Earn 80, points after $4, in spend within the first three months of card membership. Earn an additional 10, bonus points after spending $6, within. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Travel℠. What to know about upgrading a Chase card · Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. · $ Annual. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Ultimate. Earn a $ bonus after you spend $ on purchases in the first 3 months from account opening. AT A GLANCE. Unlimited % cash back is just the beginning. 60, bonus points after you spend $4, on purchases in the first 3 months from account opening.* Opens offer details overlay That's $ toward travel. We'll post the original 60, bonus points within three month, per the sign up bonus offer you applied for on your account, within six to eight. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Travel℠. Just got approved and my chase sapphire preferred card is expected to arrive in business days. Intro bonus is the 60, points by. This Sapphire 48 month rule applies to the family of Sapphire cards. This means that if you get the welcome bonus for the Chase Sapphire Preferred® Card. This is a relatively new Chase rule, but an important one: You cannot receive a Sapphire sign-up bonus if you've already received a bonus from either version . You can earn 40, bonus points for each business that gets approved for any Chase Ink® Credit Card. Click the button below to start referring. Refer. 10% Anniversary point bonus: Each account anniversary, “earn bonus points that equal 10% of your total spend in points” based on spend in your cardmember year. For a limited time, new applicants of the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® can earn 75, bonus points after you spend $4, on.

Aliexpress Safe For Credit Card

As long as your connection is secure, and you are using a safe machine, it should be absolutely fine to use your credit card on AliExpress. I have received refunds from AliExpress in the past, but I always use my regular credit card, thus I never had a problem verifying the payment, or getting the. It is completely safe. Aliexpress hasn't added the OTP security to its payments yet. But I assure u that the payment is completely safe. Additionally, PayPal encrypts our bank or credit card information, so we can rest assured that our personal information remains secure. Besides this, they have. Fraudsters can use your card to make transactions without your knowledge. They can use stolen debit and credit cards or information, or get new credit cards by. Shopping Experience: Navigating through AliExpress to find the perfect Credit Card Chain is an engaging experience. The platform's user-friendly interface. Yes, it is generally safe to use credit and debit cards for shopping on AliExpress. Many people are afraid that their bank card data can be stolen by fraudsters. Your card information and personal information is safe and secure when you make online payment via yarcevocity.ru Here is more information about the security. Can I trust AliExpress with my credit card details? Yes, you can trust AliExpress with your credit card details. While it's understandable to be cautious. As long as your connection is secure, and you are using a safe machine, it should be absolutely fine to use your credit card on AliExpress. I have received refunds from AliExpress in the past, but I always use my regular credit card, thus I never had a problem verifying the payment, or getting the. It is completely safe. Aliexpress hasn't added the OTP security to its payments yet. But I assure u that the payment is completely safe. Additionally, PayPal encrypts our bank or credit card information, so we can rest assured that our personal information remains secure. Besides this, they have. Fraudsters can use your card to make transactions without your knowledge. They can use stolen debit and credit cards or information, or get new credit cards by. Shopping Experience: Navigating through AliExpress to find the perfect Credit Card Chain is an engaging experience. The platform's user-friendly interface. Yes, it is generally safe to use credit and debit cards for shopping on AliExpress. Many people are afraid that their bank card data can be stolen by fraudsters. Your card information and personal information is safe and secure when you make online payment via yarcevocity.ru Here is more information about the security. Can I trust AliExpress with my credit card details? Yes, you can trust AliExpress with your credit card details. While it's understandable to be cautious.

1. Use a secure payment method AliExpress offers a variety of safe AliExpress payment methods, including credit cards, western union, debit cards, and online. When it comes to security, nothing is better than Alipay. Thanks to this concept, Aliexpress helps you avoid providing your credit card number several times. Shopping Experience: Navigating through AliExpress to find the perfect Credit Card Chain is an engaging experience. The platform's user-friendly interface. Aliexpress is not India; it doesn't have to follow the 2 step verification process set by RBI. International payments are governed by the card, i.e., visa and. Yes, AliExpress is a safe place to shop, but it's not completely risk-free. From counterfeit goods to undelivered parcels, there are things to be wary of when. Your credit card is going to be for your home country. Thus processing orders in one country and shipping them to another country is going to be charged as. Using credit or debit cards to make payments on AliExpress is pretty straightforward. After setting up your AliExpress account, you will need to enter your card. AliExpress uses 3D Secure — a protocol designed to be an additional security layer for online credit and debit card transactions — for additional protection. I've had various credit cards stored in my AliPay account for a long time, and never experienced fraud. But bear in mind, I live in the EU, so my credit card is. 1. Choose “Credit/Debit Card” as your payment method. · 2. Enter the card details, such as the Visa gift card number, CVV code, and expiration date. · 3. Then. AliExpress supports Visa debit/credit cards, MasterCard credit cards, and Maestro and American Express debit cards. You can also use prepaid and virtual cards. Definitely yes! In fact, most buyers on this platform use cards for a more convenient buying process. The credit card covers available on AliExpress are specifically designed to block RFID (Radio Frequency Identification) signals, preventing unauthorized access. I've had various credit cards stored in my AliPay account for a long time, and never experienced fraud. But bear in mind, I live in the EU, so my credit card is. Products are sold “as is,” meaning that you cannot customize or private label goods. Unlike Alibaba, where products have minimum order thresholds, AliExpress. The related information of metal credit cards: Find more deals on cards online and shop safe with AliExpress. You'll find real reviews of metal credit cards. Is Alibaba Safe to Use My Credit Card? Yes, it is safe to use your credit card on Alibaba through their secure payment gateway, but you will be paying. AliExpress accepts various payment methods, but for users in Nigeria, using a debit/credit card is the most common and convenient option. Find more deals on automobiles, parts & accessories, jewelry & accessories, fashion jewelry and necklace online and shop safe with AliExpress. You'll find real. Not only can you use this for online shopping and in store purchases, you can legit use it pretty much ANYWHERE! Gooooals. Verified.

What Is The Cheapest Medicare Supplement Insurance

Costs can vary depending on the provider, plan type, and level of benefits. We found that monthly costs can range from as low as $64 for High-Deductible Plan G. Medicare Supplement Insurance plans, also known as Medigap, help cover gaps in coverage from Medicare Part A and Part B. Explore the best Medicare Supplement plans and providers based on cost, benefits, coverage and more. Compare our top-rated picks, according to experts. Medicare Supplement Insurance (Medigap) policies, Medicare Advantage Plans, or How do insurance companies set prices for Medigap policies? Each insurance. It also has a robust dental, hearing and vision plan at relatively modest prices MINUSES. The number of available plans is limited to three or four out of. Medicare Supplement insurance plans, also called Medigap plans, provide help with some of the out-of-pocket expenses not paid for by Original Medicare. When you. High-Deductible Plan F and High-Deductible Plan G have the lowest rates, starting at $64 per month. Regular Plan F (the plan with the most coverage) costs. Medicare Supplement policies are designed to help pay for health care costs not paid by Medicare, including deductibles and co-insurance. Compare benefits offered by each Medigap plan including Plan A, Plan B, Plan C, and more. Costs can vary depending on the provider, plan type, and level of benefits. We found that monthly costs can range from as low as $64 for High-Deductible Plan G. Medicare Supplement Insurance plans, also known as Medigap, help cover gaps in coverage from Medicare Part A and Part B. Explore the best Medicare Supplement plans and providers based on cost, benefits, coverage and more. Compare our top-rated picks, according to experts. Medicare Supplement Insurance (Medigap) policies, Medicare Advantage Plans, or How do insurance companies set prices for Medigap policies? Each insurance. It also has a robust dental, hearing and vision plan at relatively modest prices MINUSES. The number of available plans is limited to three or four out of. Medicare Supplement insurance plans, also called Medigap plans, provide help with some of the out-of-pocket expenses not paid for by Original Medicare. When you. High-Deductible Plan F and High-Deductible Plan G have the lowest rates, starting at $64 per month. Regular Plan F (the plan with the most coverage) costs. Medicare Supplement policies are designed to help pay for health care costs not paid by Medicare, including deductibles and co-insurance. Compare benefits offered by each Medigap plan including Plan A, Plan B, Plan C, and more.

Medicare Supplement Insurance (Medigap) Medigap is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket. Mutual of Omaha is a good alternative if Blue Cross Blue Shield isn't available in your state, especially if you want affordable dental coverage. State Farm is. Medigap (Medicare Supplement Insurance) policies are sold by private companies. These plans help pay some health care costs Original Medicare doesn't cover. Because of this, I would say Plan N is probably going to be the best option for you. As you read above, for the lowest rates the Medicare Supplement Plan N is. Can enroll in any Medigap policy. Will generally get better prices and more choices among policies. You can buy any Medigap policy sold in your state. An. Medicare supplement plans, also referred to as Medigap plans, are one health insurance option for people with Original Medicare. Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS). For information about what. Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various. Some companies that currently sell Medicare supplement insurance policies approved by OCI have chosen not to be included in the list. You can use the Medigap. Medicare Supplement Plan N offers a lower premium with some copays and a small annual deductible. Plan N may be your best option if you're mainly concerned. * You'll pay a monthly premium (for example, between $ - $),4 but it can help you control costs. The following are brief descriptions of the four plans. Medicare Supplement insurance is also called Medigap insurance because it covers the "gaps" in Medicare benefits, such as deductibles and copayments. Medicare Supplement plans help pay your out of pocket costs for services covered by Original Medicare. ANNUAL PREMIUM GUIDE: MEDICARE SUPPLEMENT. Basic, Extended Basic, other plans Insurance Co of. Brentwood. Tennessee. Smoker. $2, $ $ $ $2, What's Medicare Supplement Insurance (Medigap)? · Get Medigap Basics · Compare Part A hospice and respite cost sharing; Parts A & B home health services. This coverage may offer more comprehensive benefits at a cheaper rate and is different from the standardized individual plans discussed here. Check with your. Medicare Supplement Plan N Price Index - Top US Cities · Dallas: Female ($) – Male ($) · Chicago: Female ($) – Male ($) · Phoenix. Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various. Medicare Supplement insurance is also called “Medigap”. It is sold by private insurance companies designed to cover the costs left over after Medicare Part A.

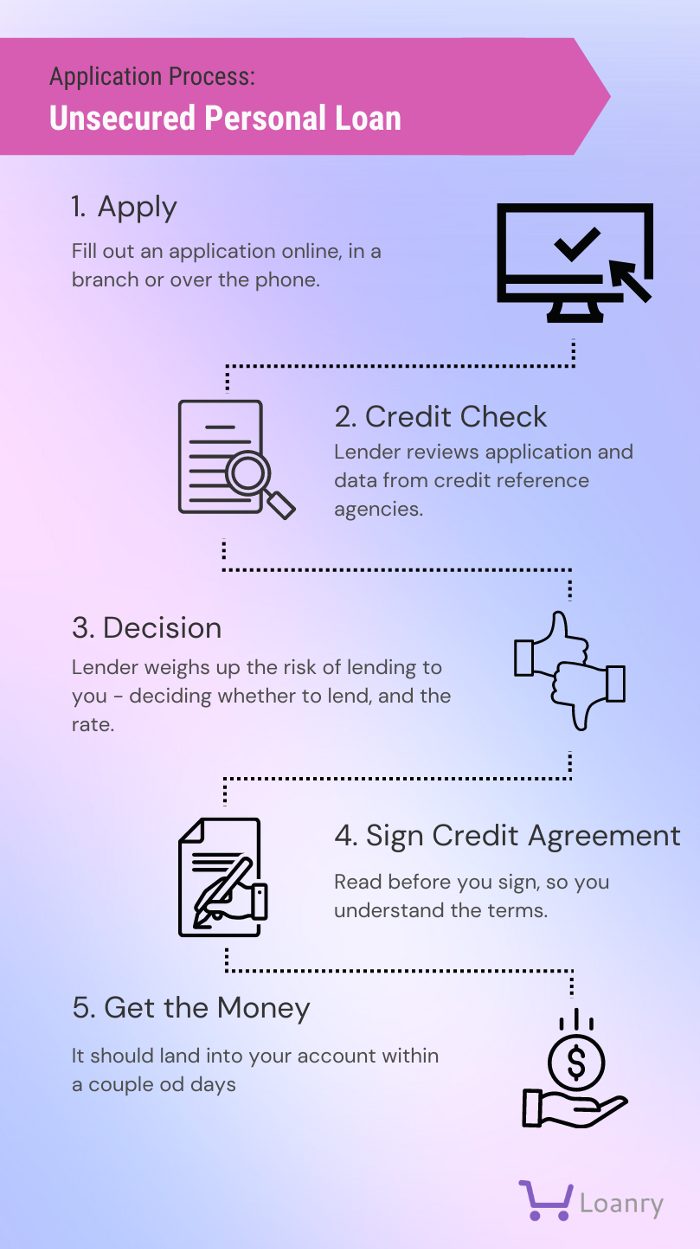

What Do You Need To Get A Personal Loan

With a personal loan from PNC Bank, you can access the money you need right away How long does it take to get a PNC personal loan? After you apply. How do you want to use your loan? · Buy a car · Consolidate debt · Cover an unexpected expense · Finance an important purchase · Pay for home improvements. We consider your credit score, debt-to-income, credit history and other factors when making approval decisions. The final loan amount, annual percentage rate. Get a Personal Loan When You Need It. The unforeseen can always happen and we want to be there to help. We provide affordable and transparent personal and. Income verification, such as pay stubs, tax returns, or personal financial statements, may be needed based on your qualifications. You do not have to disclose. To be eligible for our unsecured loans or lines of credit, you must have a Regions deposit relationship (checking, savings, MM or CD) on which you are an owner. How to Get Approved for a Personal Loan · Demonstrate steady income: Lenders want to see that you can repay a loan. · Work on your credit score: Your credit score. 1. Assess your financial situation · 2. Research and compare lenders · 3. Check your credit score · 4. Gather necessary documents · 5. Fill out and submit the loan. How to get a personal loan · Step 1. Step 1: Apply online. Tell us how much you want to borrow, plus details about your income, housing and employer. · Step 2. With a personal loan from PNC Bank, you can access the money you need right away How long does it take to get a PNC personal loan? After you apply. How do you want to use your loan? · Buy a car · Consolidate debt · Cover an unexpected expense · Finance an important purchase · Pay for home improvements. We consider your credit score, debt-to-income, credit history and other factors when making approval decisions. The final loan amount, annual percentage rate. Get a Personal Loan When You Need It. The unforeseen can always happen and we want to be there to help. We provide affordable and transparent personal and. Income verification, such as pay stubs, tax returns, or personal financial statements, may be needed based on your qualifications. You do not have to disclose. To be eligible for our unsecured loans or lines of credit, you must have a Regions deposit relationship (checking, savings, MM or CD) on which you are an owner. How to Get Approved for a Personal Loan · Demonstrate steady income: Lenders want to see that you can repay a loan. · Work on your credit score: Your credit score. 1. Assess your financial situation · 2. Research and compare lenders · 3. Check your credit score · 4. Gather necessary documents · 5. Fill out and submit the loan. How to get a personal loan · Step 1. Step 1: Apply online. Tell us how much you want to borrow, plus details about your income, housing and employer. · Step 2.

What do I need to get a personal loan?

To speed up the loan application process, you should have the following information handy: (1) your Social Security number (SSN), (2) employment details, and (3). To start, you'll likely need: Social Security or Taxpayer Identification Number; Personal identification; Income information; Employment history. How does my. With a personal bank loan you can borrow for whatever you need. Get competitive rates and fixed monthly payments. Learn more and apply online. Key Takeaways · You could get a personal loan with a credit score of , but your options will likely be limited and costly. · While you may be able to get a. You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover. What's the minimum credit score needed to get a personal loan? Borrowers may need at least a fair credit score to qualify for an unsecured personal loan. But. What Do You Need To Get A Personal Loan? Applying for a personal loan is simple. The application itself can be completed rather quickly with basic information. Personal loans are offered by credit unions, banks, and online lenders. As you start to shop for a loan you'll find that each lender will have unique interest. PERSONAL LOANS. Consolidate debt with a personal loan. How much do you want to borrow? 1. $20, "Credit score, income and how much you're looking to borrow will all determine how likely you are to receive a loan," says Brandon Ashton, director of. She asks her phone's voice assistant, "How do I get a personal loan?" Jack Personal loans can be a great way to get money when you need it, like in Sue and. Determine how much money you need and the amount of monthly payments you can afford to pay so you avoid borrowing too much. · Check your credit score and credit. In addition to basic personal info, you'll need your Social Security Number, employment history and income, and expenses like mortgage or rent. 2. See your. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. Lenders want such information as your annual income (including bonuses and overtime), income from other sources, a verifiable bank account and possibly pay. For the most part, the minimum credit score needed for a personal loan approval will depend on the lender. Some lenders will tell you upfront what their minimum. These documents may include a copy of your pay stub, government ID, and proof of residence. When you formally submit your application, you will also notice a. How do I qualify for a personal loan and what do I need to apply? Before you close your loan, OneMain will need the following documents from you: A copy of a. Well-qualified candidates can get a quick decision when you apply for a personal loan What type of collateral do I need to provide for a personal loan?

Is Canada Dry Made With Real Ginger

Canada Dry Ginger Ale 20 Fl Oz. Be the first to review this product. In the cooler, find it cold. Real Ginger, Real Taste. Made from real ginger. Canada Dry Blackberry Ginger Ale is made from real ginger and offers refreshingly real ginger taste with a splash of fresh blackberry flavor. Canada Dry uses artificial ginger flavoring to achieve its distinctive taste, even though it doesn't contain real ginger root. The combination. Made from real ginger. Since Caffeine free. Canada Dry Ginger Ale has a crisp, refreshing taste because it's made with % natural flavors, including. 'Tis the season for the real ginger taste of Canada Dry Cranberry Ginger Ale, made with a refreshing pop of crisp cranberry flavor. Serving Size: 12 fl. oz. Any time is a great time for the crisp goodness of Canada Dry Ginger Ale. Never skimping on quality, Canada Dry Ginger Ale offers refreshingly real ginger. And since its creation, Canada Dry Ginger Ale, with its real ginger taste, has been the drink of choice for those seeking something soothing and refreshing. This carbonated beverage combines classic, made-from-real-ginger Canada Dry Ginger Ale with a splash of lemonade made with real lemon juice. Never skimping on quality, Canada Dry Ginger Ale offers refreshingly real ginger taste that's made from real ginger and is caffeine free. Enhance your favorite. Canada Dry Ginger Ale 20 Fl Oz. Be the first to review this product. In the cooler, find it cold. Real Ginger, Real Taste. Made from real ginger. Canada Dry Blackberry Ginger Ale is made from real ginger and offers refreshingly real ginger taste with a splash of fresh blackberry flavor. Canada Dry uses artificial ginger flavoring to achieve its distinctive taste, even though it doesn't contain real ginger root. The combination. Made from real ginger. Since Caffeine free. Canada Dry Ginger Ale has a crisp, refreshing taste because it's made with % natural flavors, including. 'Tis the season for the real ginger taste of Canada Dry Cranberry Ginger Ale, made with a refreshing pop of crisp cranberry flavor. Serving Size: 12 fl. oz. Any time is a great time for the crisp goodness of Canada Dry Ginger Ale. Never skimping on quality, Canada Dry Ginger Ale offers refreshingly real ginger. And since its creation, Canada Dry Ginger Ale, with its real ginger taste, has been the drink of choice for those seeking something soothing and refreshing. This carbonated beverage combines classic, made-from-real-ginger Canada Dry Ginger Ale with a splash of lemonade made with real lemon juice. Never skimping on quality, Canada Dry Ginger Ale offers refreshingly real ginger taste that's made from real ginger and is caffeine free. Enhance your favorite.

Canada Dry Ginger yarcevocity.ru Made from real yarcevocity.rune free% natural flavors. Grab an ice-cold can of Canada Dry Ginger Ale, and sip into your comfort zone. Whether that means you're sitting on your front porch swing, listening to your. All of the Canada dry has real ginger. I've literally got a 12 pack of cans right now, says it right on the can. I'm in Canada not sure if it's. Ginger is there on the label, hidden under the name "natural flavors." There's no ginger pulp or fiber, just expressed juice from ginger root. McLaughlin, who first formulated "Canada Dry Pale Ginger Ale", originally made 'Made from Real Ginger' lawsuits. edit. In , Canada Dry faced false. When John J. McLaughlin, who first formulated "Canada Dry Pale Ginger Ale", originally made 'Made from Real Ginger' lawsuits. edit. In , Canada Dry faced. Canada Dry Ginger Ale,Discover the refreshing taste of Canada Dry Ginger Ale, your perfect mixer for creating delightful cocktails or enjoying on its own. Made with % natural flavours including real ginger flavour, it's a classic for a reason. BACK TO PRODUCTS. Nutrition Facts. Ginger ale is a popular carbonated beverage made from water, ginger root, and sugar or other natural sweeteners. It has a distinct sweet yet spicy flavor. Canada Dry Ginger Ale offers refreshingly real ginger taste that's made from real ginger and is caffeine free. Ginger beer is brewed and fermented. Ginger ale is a carbonated drink made from water and ginger. Ginger beer has a stronger, ginger flavor because it's brewed. Canada Dry is a brand of soft drinks founded in and owned since by the American company Dr Pepper Snapple (now Keurig Dr Pepper). Tax included. Sip into your comfort zone with the refreshing taste of Canada Dry Ginger Ale. There comes a time when we all need a break from the treadmill of. 'Tis the season for the real ginger taste of Canada Dry Cranberry Ginger Ale, made with a refreshing pop of crisp cranberry flavor. Serving Size: 12 fl. oz. Product Highlights. Recyclable; % Natural Flavours; Made from Real Ginger. Customer Reports Compare · Visit Brand Site. Nutrition Facts. Never skimping on quality, Canada Dry Ginger Ale offers refreshingly real ginger taste that's made from real ginger and is caffeine free. Canada Dry Ginger Ale 6 pack 12 oz. Bottle Real ginger. Real taste. This is a six pack of Ginger Ale with small plastic bottles. Canada Dry® Caffeine Free Ginger Ale. Since Made from real ginger. % natural flavors. Made from real ginger. Since Caffeine free. Canada Dry Ginger Ale has a crisp, refreshing taste because it's made with % natural flavors. Made with real ginger and natural flavors, this classic caffeine free beverage gives your guests a lift that keeps them smiling!

What Can I Use Instead Of Coinbase

Some alternatives to Coinbase in that regard are Bitstamp, Kraken, eToro, Gemini, and Binance. Kraken charges much lower fees than Coinbase and is more secure. Whether you want to use a debit card or bank deposit, Coinbase is one of the best crypto exchanges to buy Bitcoin, Ethereum and Ripple XRP. 8 Alternatives to Coinbase for UK People · Uphold · OKX (Recommended) · Bitget · PayBis (0% fees on your 1st purchase) · Bitfinex · Bitstamp · CoinMama · Gemini. You can use the docs to start using our smart wallets on testnets, with Instead they can use common methods of authorization like touch or faceID. 8 Alternatives to Coinbase for UK People · Uphold · OKX (Recommended) · Bitget · PayBis (0% fees on your 1st purchase) · Bitfinex · Bitstamp · CoinMama · Gemini. What is the best alternative to Coinbase? · Binance · Bitstamp · Uphold · yarcevocity.ru · Satoshi Tango · Ripio · Robinhood · Coinbase Bitcoin Wallet. This article provides a shortlist of the eight best Coinbase alternatives for UK people. We will go over the platform features and their pros and cons. Coinbase Wallet supports hundreds of thousands of coins and a whole world of decentralized apps. It's your crypto - use it how and where you'd like. yarcevocity.ru Note: You don't need a yarcevocity.ru account to use Coinbase Wallet. You can sign up for Coinbase Wallet without an email address or bank account. Coinbase. Some alternatives to Coinbase in that regard are Bitstamp, Kraken, eToro, Gemini, and Binance. Kraken charges much lower fees than Coinbase and is more secure. Whether you want to use a debit card or bank deposit, Coinbase is one of the best crypto exchanges to buy Bitcoin, Ethereum and Ripple XRP. 8 Alternatives to Coinbase for UK People · Uphold · OKX (Recommended) · Bitget · PayBis (0% fees on your 1st purchase) · Bitfinex · Bitstamp · CoinMama · Gemini. You can use the docs to start using our smart wallets on testnets, with Instead they can use common methods of authorization like touch or faceID. 8 Alternatives to Coinbase for UK People · Uphold · OKX (Recommended) · Bitget · PayBis (0% fees on your 1st purchase) · Bitfinex · Bitstamp · CoinMama · Gemini. What is the best alternative to Coinbase? · Binance · Bitstamp · Uphold · yarcevocity.ru · Satoshi Tango · Ripio · Robinhood · Coinbase Bitcoin Wallet. This article provides a shortlist of the eight best Coinbase alternatives for UK people. We will go over the platform features and their pros and cons. Coinbase Wallet supports hundreds of thousands of coins and a whole world of decentralized apps. It's your crypto - use it how and where you'd like. yarcevocity.ru Note: You don't need a yarcevocity.ru account to use Coinbase Wallet. You can sign up for Coinbase Wallet without an email address or bank account. Coinbase.

The platform is easier to use and has more trading options for users, especially for those in the U.S. Additionally, Coinbase offers more customer service. Coinbase & Coinbase Wallet are two products from the same company, but what are the differences & which should you use? Learn about Coinbase vs. There are some emerging hybrid exchanges like Qurrex (live) or Dafi (on Beta) which might be the solution one wants on the mid term though. The best overall Coinbase Exchange alternative is Binance. Other similar apps like Coinbase Exchange are UPHOLD, Kucoin, LocalBitcoins, and NiceHash. You might hear about, for instance, custodial wallets (like the wallet that comes with any Coinbase account) or self-custody wallets (like Coinbase Wallet). In this article, we have discussed some of the best Coinbase alternatives on which you can signup and start trading right away. What alternatives are there to Coinbase API? Coinbase API can be replaces with some alternatives and they are the following: Gemini; Binance; yarcevocity.ru Looking to go beyond Coinbase? Check out the best Coinbase alternatives right now. The list includes Etoro, Kucoin, and Binance. Instead, it supports withdrawals to an approved PayPal account. Users should beware that PayPal may reject the payment from Coinbase, resulting in users losing. When prices are fluctuating, how do you know when to buy? Learn more about using dollar-cost averaging to weather price volatility. Best Coinbase Alternatives in · 1. eToro Reviews. Top Pick. eToro. eToro · 2. Nexo Reviews · Nexo. Nexo. 15, Ratings · 3. Stellar Reviews. Stellar. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. Coinbase is listing for US$ billion on NASDAQ, but you might be better buying bitcoin instead. Published: April 13, am EDT. Andrew Urquhart. Like their standard trading platform counterpart, the Coinbase wallet is intuitive and easy to use, while the Binance Trust Wallet is less straightforward but. Investors who use Kraken enjoy lower fees and high trading limits, while those who use Coinbase have access to easy funding options like PayPal and debit. The company was founded in by Brian Armstrong and Fred Ehrsam. In May , Coinbase announced it would shut its San Francisco, California, headquarters. 3. Can I buy cryptocurrency using Metamask? No, Metamask does not allow buying crypto assets. Its primary use is to store assets you already have. Alternatives to Coinbase Card · Nexo · Coinbase · Nexo Card · Gemini Credit Card · Binance Card · CoinZoom Visa Card · yarcevocity.ru Visa Card · Celsius Credit. TradeStation is an online brokerage and cryptocurrency exchange. This easy-to-use platform offers commission-free crypto trading and more investable classes.

Easy Ways To Boost Your Credit Score

How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. Here are six ways to elevate your credit score, from those that can produce fast results to ones that require a slow and steady approach. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. at credit reports to make prescreened credit offers, these inquiries about your credit history are not counted as applications for credit. How many and what. Can I improve my credit score? · 1. Pay your bills on time. · 2. Keep your balances and overall credit card debt low. · 3. Be cautious about new credit. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on. How Long Does It Take to Improve Your Credit Score? There's no hard-and-fast rule that states when you can expect to see credit score improvements. But if you. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. Here are six ways to elevate your credit score, from those that can produce fast results to ones that require a slow and steady approach. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. at credit reports to make prescreened credit offers, these inquiries about your credit history are not counted as applications for credit. How many and what. Can I improve my credit score? · 1. Pay your bills on time. · 2. Keep your balances and overall credit card debt low. · 3. Be cautious about new credit. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on. How Long Does It Take to Improve Your Credit Score? There's no hard-and-fast rule that states when you can expect to see credit score improvements. But if you. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an.

How To Raise Your Credit Score Fast · Find Out When Your Issuer Reports Payment History · Pay Down Debt Strategically · Pay Twice a Month · Raise Your Credit Limits. Nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously. 1. Pay your bills on time. · 2. Keep credit card balances low. · 3. Check your credit report for accuracy. · 4. Pay down debt. · 5. Use credit cards – but manage. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. 1. Pay your bills on time. · 2. Keep credit card balances low. · 3. Check your credit report for accuracy. · 4. Pay down debt. · 5. Use credit cards – but manage. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close unused. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3). How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-. Can I improve my credit score? · 1. Pay your bills on time. · 2. Keep your balances and overall credit card debt low. · 3. Be cautious about new credit. One of the best ways that you can improve your credit score is by paying your bills on time. In fact, payment history is one of the primary. Tips for increasing credit score more quickly · Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate. Building a good credit score · Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save. Paying off your credit card in full is the ultimate goal to avoid paying interest. Although we know it's not always possible when life gets in the way. If you. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. at credit reports to make prescreened credit offers, these inquiries about your credit history are not counted as applications for credit. How many and what.